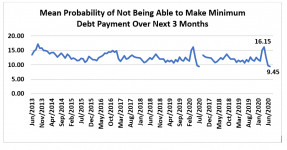

The unemployment benefits that about 29 million people receive have provided a boost to household incomes, enabling them to stay afloat and pay their debt and bills.

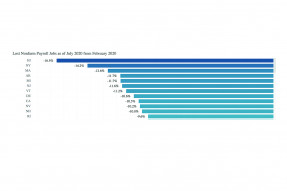

The unemployment rate fell to 8.4% as 1.4 million more jobs were added in August. Total job additions from the low point during the lockdown are now over 10 million, but another 10 million jobs are needed to get us back to pre-pandemic conditions.

The unadjusted new jobless claims suggest that there was a slight change last week in the number of people applied for benefits.

Mortgage rates inched up this week to average 2.93% from 2.91% the prior week. However, mortgage rates remain near record lows below 3%.

The coronavirus pandemic period has shown that workers can work at home productively given the state of technology that enables workers to access their work files from anywhere, collaborate, and stay connected. This means that working from home or remotely is likely to become part of the workforce culture.

The retail market is no longer recovering and is now surging as U.S. retail and food service sales ramped up in July.

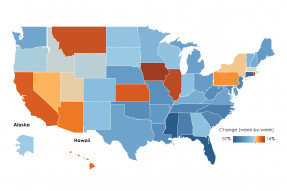

The July figures show strong employment growth, but the gains are not yet at a level that fully recovers the lost jobs. Jobs are coming back in the Northeast states, but they have the most lost ground to recover still.

A drop in claims for unemployment checks implies that even with new layoffs there are job creations and people are able to come off unemployment.

Mortgage rates dropped this week to average 2.91%, from 2.99% the prior week.

Several indicators point to the quick recovery of the housing market from the pandemic slump during April and May, with home sales on an annualized rate in July now above the February level.

Search Economists' Outlook