While consumers are not spending on traveling, eating out, and other retail experiences, real PCE in September reflects increased spending towards retail goods, $109.9 billion, while services saw an increase as well of $61 billion.

While the economy grew at its fastest pace ever in the third quarter as a nation, fewer people applied for unemployment benefits last week. Both new and total claims continue to drop, implying that more people are able to find jobs again.

Among all families, the ownership of a primary residence typically accounts for 90% of total wealth.

With mortgage rates hovering near record lows, expect real estate to continue to stay strong, boosting economic growth.

The economy is now out of the technically deepest recession in US history as the GDP rose at an annualized rate of 33.1% in the third quarter.

Amid more intense buyer competition, rising prices, and higher credit qualifications, the share of first-time buyers continued to decline to 31% in September.

Fewer people applied for unemployment benefits last week. Both new and total claims dropped significantly, implying that there is job creation and people are able to find jobs again.

As of September, 41 states had job gains but employment has not recovered to pre-pandemic levels (February 2020) in all states.

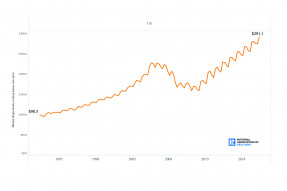

Seasonally adjusted advanced estimates of United States retail and food services sales continued its upward trend for the month of September as sales continue to exceed pre-pandemic levels.

REALTORS® reported conducting more home tours, with an average of nearly five in-person home tours compared to only two new listings per agent.

Search Economists' Outlook