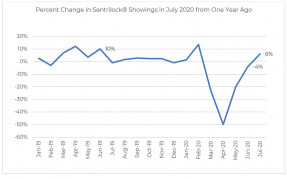

Home showings in July 2020 showed a strong rebound from the level in May, according to data from SentriLock®, LLC, a lockbox company.

Mortgage rates moved up slightly this week to an average 2.99% from 2.96% the prior week. However, the 30-year fixed-rate mortgage is still hovering at near-record lows.

New construction for both single-family and multifamily units ramped up sizably in July, up 23% from one year ago, and almost matching pre-pandemic activity in the first quarter. Such growth is needed to steadily relieve the housing shortage. This kind of growth is also a major contributor to local economic recovery.

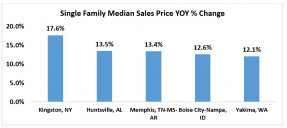

Single-family home prices continued to rise in the second quarter of 2020, with 96% of markets showing home price appreciation.

Mortgage rates bounced up lightly this week to average 2.96% from 2.88% the prior week, but this should have virtually no impact on home buying.

Affordability worsened in June compared to May as the median family income slightly declined by 1% while the median home prices rose by 4%.

Jobs are coming back, with 1.8 million net new additions in July, bringing the total to 9.3 million over the past three months as the economy has steadily reopened.

Layoffs fell to 1.2 million last week. This is a decrease of 249,000 from the previous week's revised level while hiring is picking up. That’s the lowest level of layoffs since the pandemic started.

Foreign buyers continued to pull back for the second year, purchasing $74 billion of U.S. existing homes from April 2019–March 2020, a 5% decrease from the prior 12-month period.

Interest rates dipped 11 basis points to 2.88% on a 30-year fixed-rate mortgage, continuing to hover at record-low levels. The rates may fall further over the next few weeks since the 10-year Treasury yields, off of which the government-backed mortgages are priced, retreated ever so slightly in past weeks.

Search Economists' Outlook