Unemployment rates are highest among millennials, Blacks, and those with less than a high school degree.

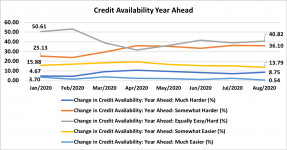

Income and credit conditions are two main factors that affect the ability of consumers in obtaining a loan, either for a home or other personal property.

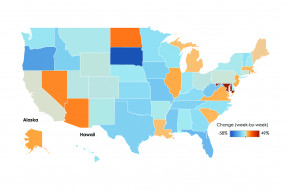

The number of people who applied for unemployment benefits dropped last week. Specifically, the unadjusted new jobless claims totaled 786,942 in the week ending September 26, a decrease of nearly 5% from the previous week.

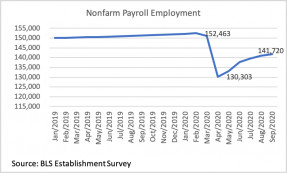

The jobs recovery continued in September, with another 661,000 net new jobs. Government jobs fell as fewer Census takers were needed, and layoffs of school support staff occurred as many courses have gone online.

The 30-year fixed-rate mortgage dropped to average 2.88% this week from 2.90% the prior week. Rates have stabilized below 3% for more than 2 months.

This blog post provides a comprehensive picture of housing in America using the trends of the following 9 factors; household growth, homeownership rate, household size, owner and rental vacancy rates, type of homes, adults living with their parents, share of income for housing, home prices, residential mobility.

About 1 million renters are most likely to file for protection from eviction and another 3.2 million are “somewhat likely” to file for protection from eviction under the CDC Order and from state eviction moratoriums.

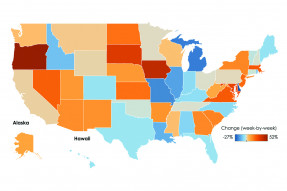

In recent months, there has been significant speculation about how the pandemic will change where Americans want to live since they can work remotely.

The unadjusted new jobless claims totaled 824,542 in the week ending September 18, an increase of nearly 4% from the previous week. However, compared to late March, the number of weekly claims has come down substantially stabilizing below 1 million for the eighth straight week.

REALTORS® reported that, on average, properties for which the sale closed in August received about 3 offers, up from 2 offers one year ago and in March when the pandemic hit.

Search Economists' Outlook