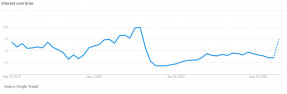

The 30-year fixed-rate mortgage rose to average 2.90% this week from 2.87% the prior week. However, mortgage rates remain near record lows, below 3%.

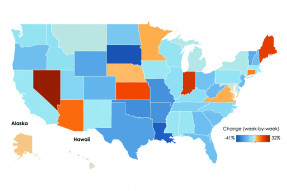

August 2020 U.S. showings were up 20% over this time last year and represent the largest year-over-year increase in Sentrilock® showings since October 2017.

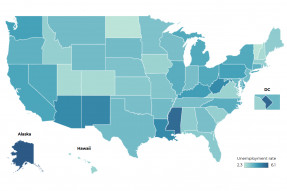

New jobless claims totaled 790,021 in the week ending September 12, a decrease of nearly 9% from the previous week. Compared to late March, the number of weekly claims has come down substantially stabilizing below 1 million for the seventh straight week.

The housing market continues to recover strongly, fueled by low mortgage rates.

Mortgage rates have stabilized near record lows but rates could fall even further this year. The 30-year fixed-rate mortgage inched up to an average of 2.87% this week from 2.86% the prior week.

Understanding the profile of landlords is important because any policy pertaining to renters also impacts landlords and their ability to provide rental housing supply.

At the national level, housing affordability showed signs of improvement in July 2020 compared to a year ago but dipped compared to June.

Unadjusted new jobless claims totaled 857,148 in the week ending September 5, an increase of 20,140 (2.4%) from the previous week.

With these ultra-low mortgage rates, the real estate market is recovering faster than expected from the pandemic.

From the beginning of the lockdown in mid-March to the latest week, there have been nearly 58 million Americans who have been laid off.

Search Economists' Outlook