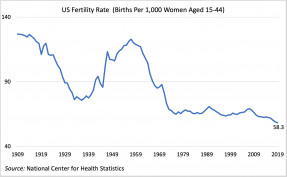

The fertility rate declined in 2019 by 1% overall, which may not seem like a sizeable change until recognizing the rate is at all-time recorded low for the last 100 years.

U.S. long-term mortgage rates rose this week but remain near historic lows, as the economy is recovering with more Americans getting vaccinated against the coronavirus.

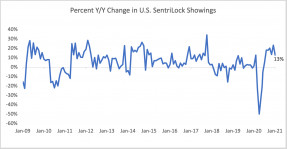

The new January 2021 NAR SentriLock Home Showings Report indicates that there was an increase in nationwide foot traffic on a month-over-month basis.

In January 2021, properties were typically on the market for 21 days, first-time buyers accounted for 33% of sales, and cash sales made up 19% of sales.

Today’s second GDP estimate for the 2020 Q4 shows the economy grew slightly higher at 4.1% than previously estimated (4% advance estimate).

Mortgage rates rose sharply this week to 2.97% as the 10-year Treasury yield hit its highest level in the past year.

The combination of increasing virus cases, stay-at-home orders and business operation limitations led to significantly reduced retail brick-and-mortar foot traffic and as a result, substantial retail store closures and significant decreases in retail employment.

Eleven billion dollars in rental assistance is needed per month to assist renters and small landlords.

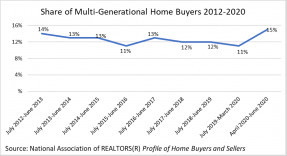

Buyers purchasing multi-generational homes during the pandemic rose to a series high of 15%.

FHA-insured financing used to be the go-to for first-time buyers who need a lower down payment, but that has changed: more first-time buyers are going with conventional rather than FHA-insured loans.

Search Economists' Outlook