The annual inflation rate rose for seven straight months in December as the economy gradually recovers from the COVID effect.

At the national level, housing affordability declined in November 2020 compared to a year ago but rose modestly compared to October.

New jobless claims rose by 77,400 to 922,072 last week, and continued claims, which measure the number of people receiving checks for regular unemployment benefits, rose to nearly 5.4 million.

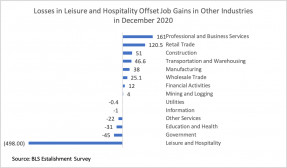

Nearly half a million job losses in leisure and hospitality wipe out job gains in December 2020 and lead to rising unemployment rate among Hispanics.

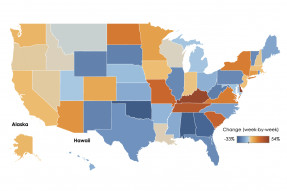

There was a decrease in nationwide foot traffic on a month-to-month basis, but home showings were up 24% year-over-year.

Mortgage rates started the new year with a new record low. The 30-year fixed mortgage rate dropped this week to 2.65% from 2.67% the previous week, although the 10-year Treasury yield is moving upwards.

2020 was a year that saw a pandemic end the longest U.S. economic expansion in history and sent other economies into an economic downturn.

On an unadjusted basis, new jobless claims dropped by 4% to 841,111. However, the number of claims remains well above pre-pandemic levels.

While the holiday spirit may warm hearts, the cooler temperatures create colder homes. Because of this, homebuyers must consider a variety of different environmental factors when deciding which home to purchase, in hopes to minimize the cost of comfort.

The coronavirus pandemic has had a more acute impact on businesses providing accommodation services (hotels, motels, bed and breakfasts) compared to all industries broadly.

Search Economists' Outlook