The average rate on the 30-year fixed rate home loan fell for the second straight week to 3.04% from 3.13% the previous week.

According to the Snapshot on Race and Home Buying in America, which uses Census ACS data, the homeownership rate for Black Americans is 42%, Hispanic Americans 48.1%, Asian Americans 60.7%, and White Americans 69.8%.

Over the last 12 months, the inflation rate rose 2.6%, compared to 1.7% in February and 1.4% in January, respectively.

The economy added nearly one million jobs in March, 2021, the fastest acceleration since August, 2020. Although the economy is creating jobs, layoffs are still happening.

Affordability declined in February compared to January as the median family income rose by 3.5% while the monthly mortgage payment increased 5%.

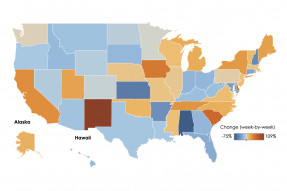

Here are the latest indicators on inventory, pending sales, home prices, job growth, and mortgage rates that are pointing to a hot spring market in a broad swath of metro areas.

Freddie Mac reported today that the average rate on the 30-year fixed rate home loan fell to 3.13% from 3.18% the previous week.

Significant job declines, health and safety issues, and government-mandated store closures created a whirlwind year for retail in 2020.

Construction jobs boomed in March with 110,000 new additions, one of the largest monthly gains ever. This raises the prospect for more home building and more inventory reaching the market in the upcoming months.

The United States remains the top commercial estate market globally, with 16 metros in the top 30 largest commercial real estate markets on a global scale.

Search Economists' Outlook