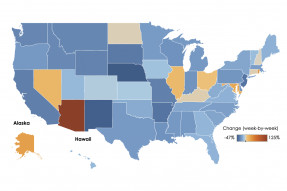

Fewer Americans filed a new unemployment claim last week, with the number of unadjusted initial claims falling to 960,668, a decrease of 151,303 claims from the prior week.

The commercial real estate market continues to struggle, but some sectors are holding up relatively well against the economic effects of the pandemic.

Mortgage rates fell slightly this week as mortgage applications decreased. With a new stimulus package a top priority of the new administration, which will give relief to millions of households and businesses, expect mortgage rates to rise modestly in the following weeks but to continue to be historically low.

Home construction finished the year with the biggest bang since 2006 with 1.669 million units started for construction in December (annualized). That means the worst of the housing shortage could soon come to an end.

Seventy-two percent of REALTORS® reported volunteering in their community, and the typical REALTOR® who volunteers is 53 years old.

December 2020 seasonally-adjusted advance estimates of United States retail and food service sales decreased from November sales figures as anticipated and represents the 3rd consecutive month of decreasing sales.

While the e-commerce portion of the U.S. CPG industry, comprised of food and beverage, general merchandise, homecare, and health and beauty, remains a small portion of total CPG sales today, it remains at an elevated level.

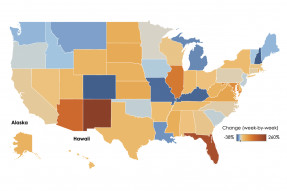

The number of unadjusted initial claims rose to 1.15 million, the highest level since the end of July. It is an increase of 231,335 from the prior week, as the re-closing of some businesses in some states is contributing to more layoffs.

As expected, mortgage rates rose this week, following the trend of the 10-year Treasury yield in the last couple of weeks.

The median existing-home price rose to $310,800 in November; 15% more than a year earlier; 41% more than five years earlier.

Search Economists' Outlook