By now, you’ve likely heard the buzz around qualified opportunity zones, areas around the country that have been given tax incentives making them ripe for economic development. Whether you’re interested in participating yourself or helping clients learn more about these investment opportunities drawn from every eligible census tract in the U.S., the National Association of REALTORS® is providing support to local REALTOR® associations to help members take advantage of the new program. REALTORS® have been connecting with community stakeholders to help identify development priorities that fall within opportunity zones in or around where they live and work.

“Members, as the boots on the ground, can help us educate others about these opportunity zone tax incentives,” says Katie Shotts, CEO of the Memphis Area Association of REALTORS®. “Residential agents may not be involved in the business of opportunity zones right away, but they know the people in the community that could be, including business -owners, residents, community development corporations, elected officials, homebuilders, and so many others, because REALTORS® are so connected in the community.”

A range of tax benefits is available to investors who invest in opportunity zones, depending on how long the investments are held. Capital gains re-invested in a zone within 180 days are tax-free for up to nine years, through 2026. If the initial investment is held for five years, the tax ultimately paid on it is reduced by 10%. After seven years, the reduction jumps to 15%. Gains accrued after 10 years are tax-free.

The Memphis Area Association was among more than 40 local REALTOR® associations that obtained a grant from NAR this year to host opportunity zone education and involvement forums. The events solicited the expertise of commercial and residential members, who provided insights about the community coordination necessary in developing an opportunity zone project. Some events featured tours of local zones, brainstorming sessions with local economic development groups, and town hall–style Q&As with government officials.

NAR made more than $175,000 in Opportunity Zone Community Planning Grants available this year to kickstart member involvement. Scott Turner, executive director of the White House Opportunity and Revitalization Council, spoke at the Birmingham (Ala.) Association of REALTORS®’ opportunity zone event in August. “We could not have brought forward this programming if it weren’t for the grant,” says Dawn Kennedy, rce, chief executive officer of the Birmingham association.

What Revitalization Does Your Community Need?

From new mass transit and affordable housing to renovated office buildings and redesigned community spaces, the opportunity zone program offers great potential for spurring home construction, job creation, and other economic activity. At the Central Panhandle Association of REALTORS® in Florida, members hope the opportunity zone program brings long overdue redevelopment to areas affected by Hurricane Michael in 2018, as well as commercial growth, new jobs, and increased property values, says association CEO Debbie Ashbrook.

In largely rural Caroline County, Va., a highway bypass built a few years ago killed local businesses when traffic was diverted away. “REALTORS® have been involved ever since working to spur redevelopment,” says Kim McClellan, public policy director at the Fredericksburg Area Association of REALTORS®. “Now that parts of Caroline County are a qualified opportunity zone, there’s a bigger chance that revitalization will happen. And REALTORS® are already at the forefront.”

Commercial practitioner David Chapman, CEO of Realty1 in Edmond, Okla., has already closed millions of dollars’ worth of deals in opportunity zones. “In my market, we have a very lucrative opportunity zone in our downtown and I know all of those properties,” he says. “I know which ones can be bought and I know the reasons some of these properties haven’t been redeveloped in the past.”

A key role for agents in opportunity zones is to keep developments from going wrong, says Chapman, and to educate investors attracted to opportunity zones who may be first-time investors.

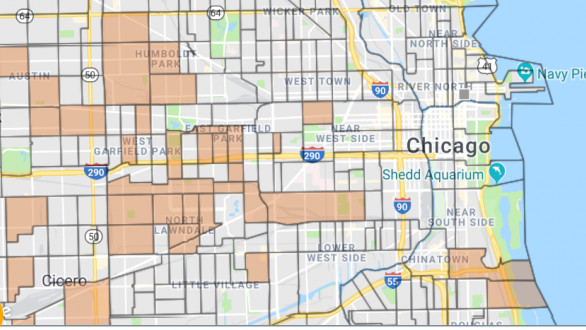

A new tool from the Realtors Property Resource® can help you and your clients learn more about the properties within opportunity zones in your area. It provides a data layer for both residential and commercial properties, showing their exact locations within a zone. You can find economic statistics and demographic information on specified areas and create property reports for investors, which can boost the marketability of properties in communities that may once have been overlooked.

Another resource for opportunity zone information is the new Qualified Opportunity Zones Toolkit on nar.realtor that includes fundamentals on the program and legislation, recently issued regulatory guidance, and links to opportunity zone maps.