WASHINGTON (April 30, 2024) — Yesterday, the Federal Housing Finance Agency (FHFA) announced their finalized Fair Lending, Fair Housing, and Equitable Housing Finance Plans to address barriers to sustainable housing opportunities. The National Association of Realtors® applauds FHFA's efforts to codify existing practices and programs, which shows a sustained commitment from the agency to remove obstacles to homeownership and expand opportunities for home buyers of all backgrounds, including first-time and low-and-moderate income buyers.

"The Equitable Housing Finance Plans are an active step in closing homeownership gaps among demographic groups," said Bryan Greene, NAR's vice president of policy advocacy. "We applaud the work that FHFA has done to support lenders who create special-purpose credit programs. This work promotes more fairness and greater soundness in the housing finance system and, ultimately, more homeownership opportunities for more Americans. We look forward to working with FHFA to further support homeownership and narrow the homeownership gaps."

According to FHFA, its expanded fair lending efforts have helped 17,000 families of all backgrounds benefit from lender-created special-purpose credit programs, offering buyers down payment assistance, closing cost assistance, and other support.

NAR also applauds FHFA for its work in credit score modernization. Changes to incorporate rental and utility payments in credit scores have resulted in positive benefits for 750,000 renters.

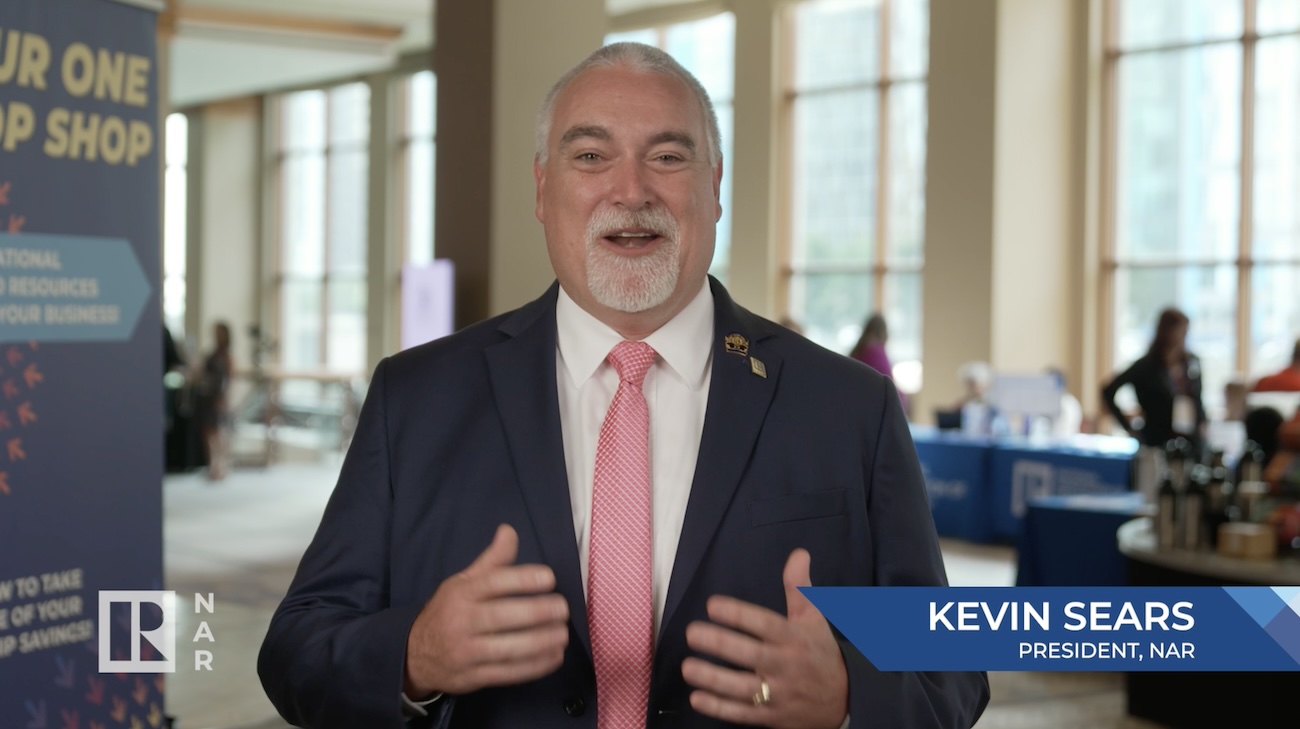

The National Association of Realtors® is America's largest trade association, representing 1.5 million members involved in all aspects of the residential and commercial real estate industries. The term Realtor® is a registered collective membership mark that identifies a real estate professional who is a member of the National Association of Realtors® and subscribes to its strict Code of Ethics.

# # #