Multi-Housing News

Several multifamily owner-operators and other industry experts are pushing back against President Joe Biden's proposed rent control plan. Critics argue that the best way to lower rents is to build more supply rather than imposing a nationwide rent cap of 5 percent, as the administration's proposal calls for.

The national rent control policy would, were it to pass the U.S. Congress, apply to landlords with upwards of 50 units in their portfolio, impacting more than 20 million units across the United States or about half of all rentals.

The Biden proposal would give corporate landlords a choice: either cap rent increases on existing units to no more than 5 percent or lose federal tax breaks for faster depreciation write-offs. The provision would last two years, presumably until more housing hits the market, and would not impact new development or properties undergoing substantial renovations.

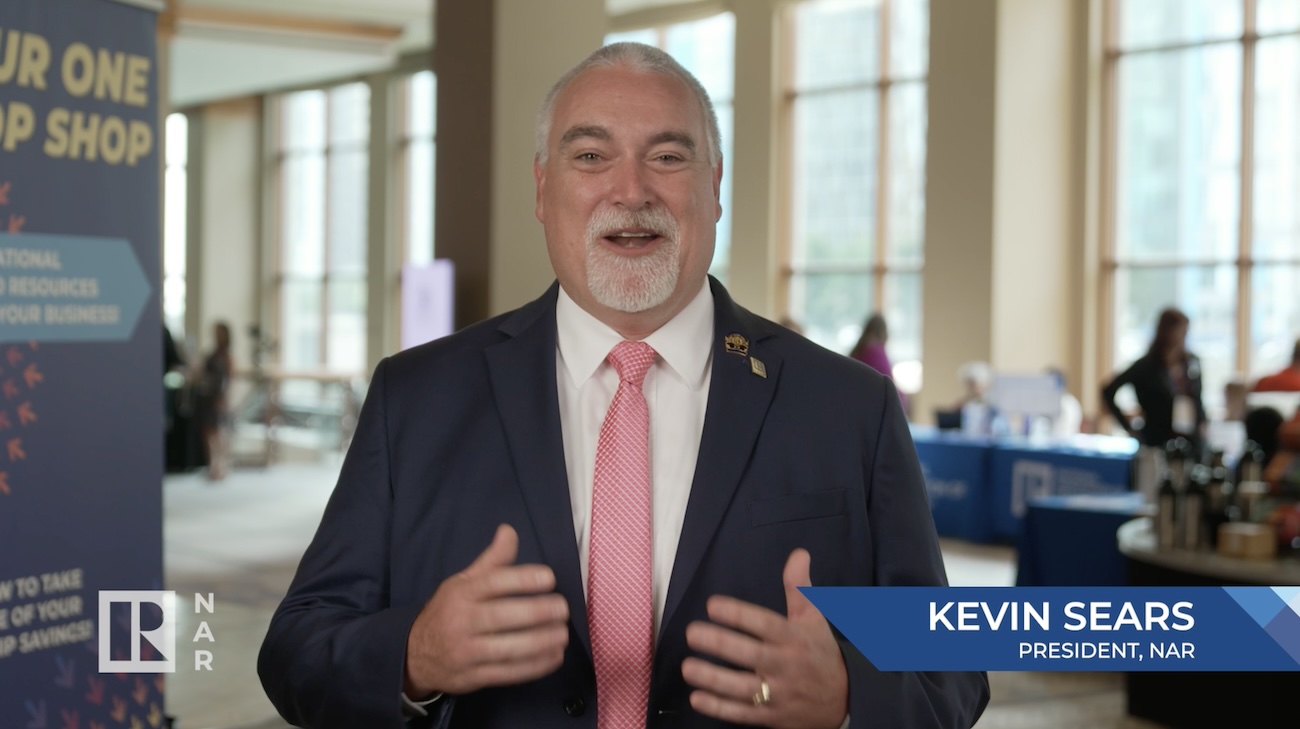

Developers are reluctant to build in areas where government imposes rent controls on new buildings, National Association of REALTORS® President Kevin Sears noted. "These policies actually decrease the supply of low- to mid-range housing units," he said in a prepared statement. "Rent control is a rare instance where the research is fairly conclusive: it doesn't work. These measures fail to improve renters' financial situation and shift the burden of economic difficulties, inflation and other costs onto the housing provider with no counterbalance."