HousingWire

The U.S. Department of Housing and Urban Development (HUD) and the Federal Housing Administration (FHA) announced a new policy on Wednesday that will enable mortgage borrowers to “request a re-assessment of the appraised value of their property if they believe that the appraisal was inaccurate or biased,” according to an announcement from HUD.

“The Reconsideration of Value (ROV) policy represents months of collaboration with the Federal Housing Finance Agency (FHFA) to develop an aligned approach for both FHA-insured mortgages and those purchased or guaranteed by Fannie Mae and Freddie Mac,” the department said.

Applying to all FHA single-family forward and reverse mortgage programs, the new FHA Mortgagee Letter (ML) enhances current ROV policy while adding additional clarified statements for appraisal reviews, according to FHA. These include “improvements to the process by which borrowers may request an ROV if they identify a problem with the appraisal.”

The guidance also requires lenders to include “a borrower-initiated ROV process meeting certain minimum requirements, including delivery of disclosures to borrowers at loan application and upon delivery of the appraisal with instructions on how to request an ROV.”

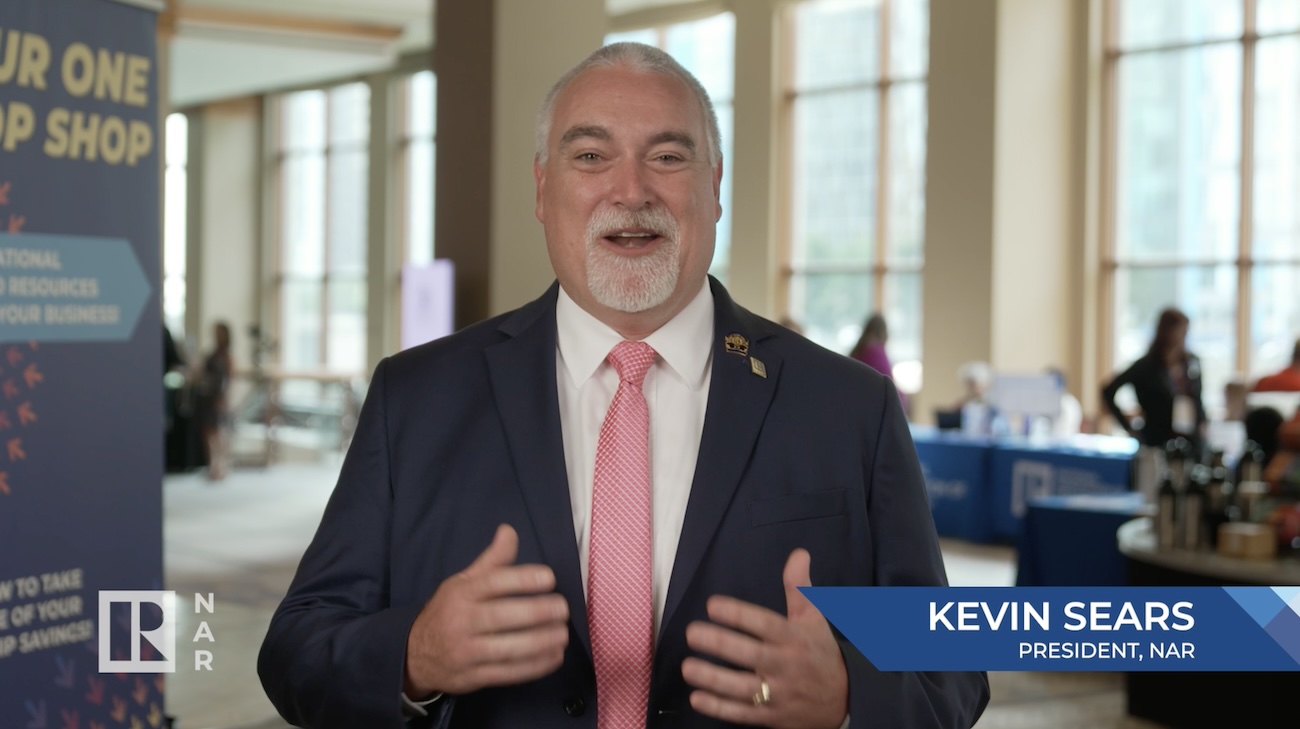

The National Association of REALTORS® (NAR) released a statement shortly after the announcement, lauding the move.

“We applaud HUD and the GSEs for establishing this process so consumers can more readily obtain a second look at appraisals when they disagree with them,” said Bryan Greene, NAR’s vice president of policy advocacy. “It empowers consumers while affording appraisers an opportunity to make sure they got it right. NAR has long advocated for updating the ROV process, seeing it as crucial to ensuring fair housing in the appraisal process. We are encouraged by HUD and the GSEs taking this significant step to support consumers nationwide.”