CNBC

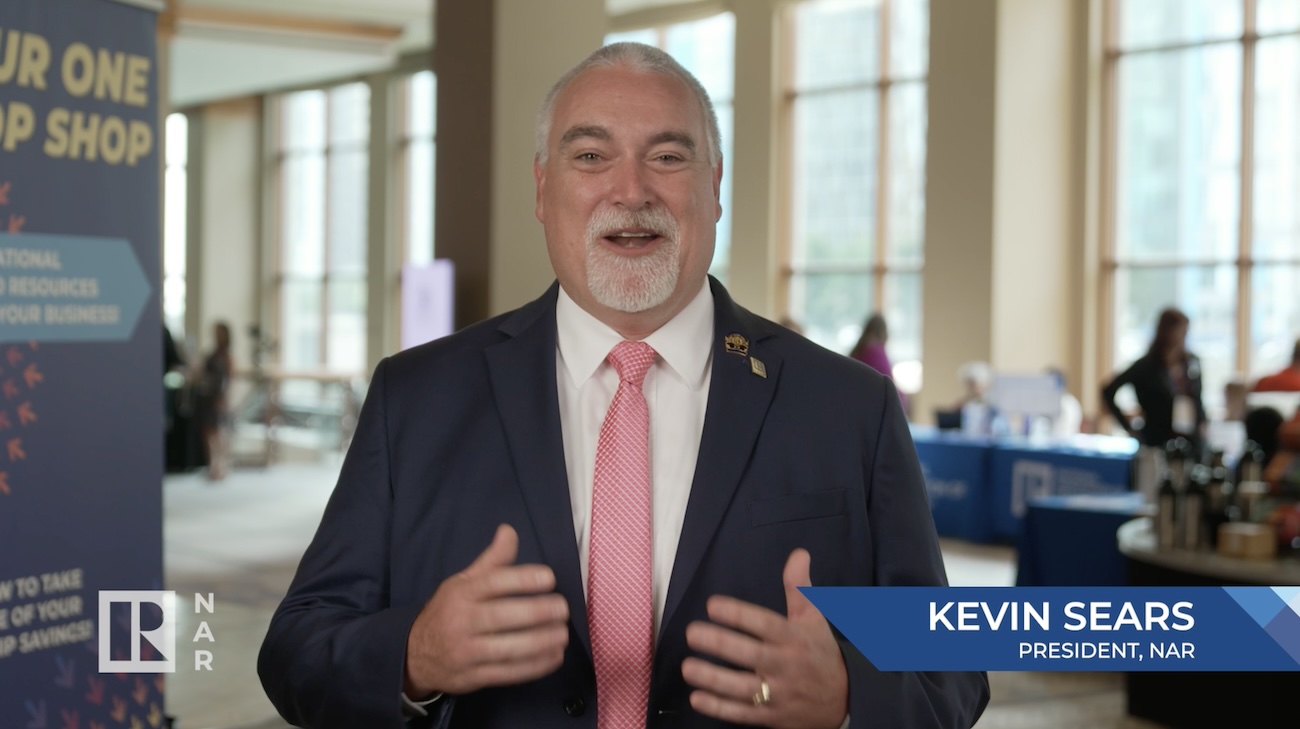

Top real estate and banking officials are calling on the Federal Reserve to stop raising interest rates as the industry suffers through surging housing costs and a “historic shortage” of available homes for sale. In a letter Monday addressed to the Fed Board of Governors and Chair Jerome Powell, the officials voiced their worries about the direction of monetary policy and the impact it is having on the beleaguered real estate market. The National Association of Home Builders, the Mortgage Bankers Association and the National Association of REALTORS® said they wrote the letter “to convey profound concern shared among our collective memberships that ongoing market uncertainty about the Fed’s rate path is contributing to recent interest rate hikes and volatility.” The groups ask the Fed not to “contemplate further rate hikes” and not to actively sell its holdings of mortgage securities at least until the housing market has stabilized. “We urge the Fed to take these simple steps to ensure that this sector does not precipitate the hard landing the Fed has tried so hard to avoid,” the group said.