Employment Gains Boost Income

The economy continued to grow at a solid annual rate of 3.0 percent in the third quarter of 2017, sustaining the growth pace from the second quarter (3.1 percent). Private consumption and investment spending continued to be the engines of growth, as the employment landscape remained bright.

Since March 2010, private payrolls have increased by an average of nearly 190,000 jobs per month, totaling 17.1 million new jobs over the period ending in October 2017. Hurricanes Harvey and Irma temporarily moderated that pace, leading to 18,000 net new jobs in September 2017. Nonetheless, the number of new jobs recovered quickly, to 252,000 in October 2017. The total number of post-recession net new jobs more than offsets the 8.8 million jobs lost during the 2008-09 recession.

The third quarter’s figures painted a solid picture of gains. Payroll employment advanced in the third quarter of 2017, to the tune of 471,000 new jobs, according to the Bureau of Labor Statistics (BLS). Private service-providing industries continued as the growth engine during the third quarter, with 383,000 net new jobs. The unemployment rate dropped to 4.3 percent in the third quarter of 2017 compared to the rate in the second quarter (4.4 percent) and one year ago (4.9 percent).

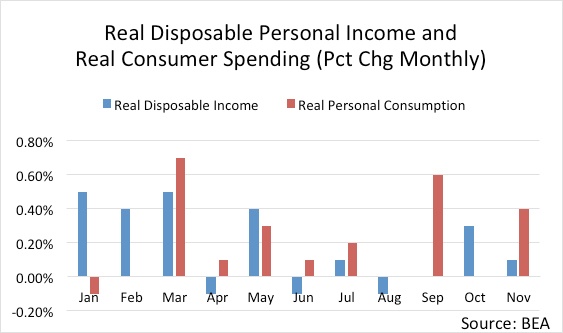

Along with employment advances, wage growth has been rising, and along with it, disposable income. Disposable personal income—adjusted for inflation—increased 1.1 percent in the third quarter, according to the BEA. Real disposable income growth was on par with the third quarter’s 1.1 percent gain, but lower than the 1.4 percent growth registered in the third quarter of 2016.

Consumption Patterns Impact Retail Sales

Riding a wave of strengthening employment figure, consumers’ optimism improved. The Conference Board’s Consumer Confidence Index indicates that consumers have become more bullish, as the index rose to 125.9 in October 2017, up from the previous month (120.6) and one year ago (100.8).

In turn, consumer spending continued on an upward trend. Private consumption spending—the largest component of gross domestic product—increased at an annual rate of 2.4 percent, in the wake a solid advance from the second quarter (3.3 percent). Reflecting the late summer/early fall season, consumers spent more on cars, trucks and SUVs, food and beverage, recreation, as well as at restaurants and hotels.

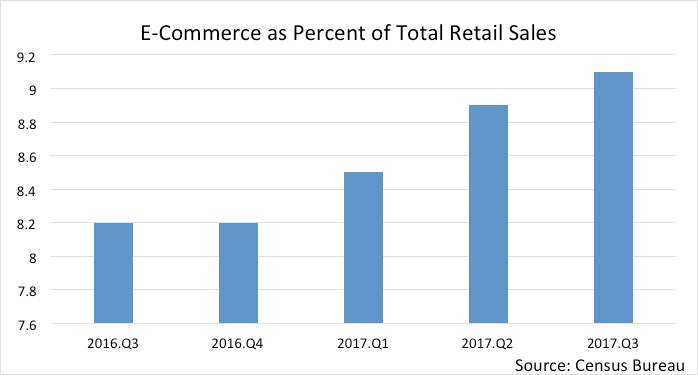

However, on the retail side, consumers continued their shift toward on-line purchases in 2017, driving strong demand for distribution centers. Retail e-commerce sales totaled $115.3 billion in the third quarter of last year, a 15.5 percent gain compared with the same quarter of the prior year, according to the Census Bureau. E-commerce sales represented 9.1 percent of total retail sales.

Retail Sector Experiences Rising Vacancies

Low unemployment rates, rising wages and improving optimism led to growing retail sales in the third quarter. Demand for retail spaces was positive, even with department store closures. Retail net absorption totaled 7.4 million square feet during the quarter, according to CBRE. Retail construction activity slowed, with completions totaling 11.3 million square feet. Retail availability rate picked up, moving to 7.0 percent in the third quarter, as asking retail rents moderated, rising 4.1 percent year-over-year, to $17.15 per square foot.

|

2017.Q3 |

|

|

Retail Availability |

7.0% |

|

Retail Net Absorption |

7.4 million sq. ft. |

|

Retail New Completions |

11.3 million sq. ft. |

|

Retail Rent Growth |

4.1% |

|

Source: CBRE |

|

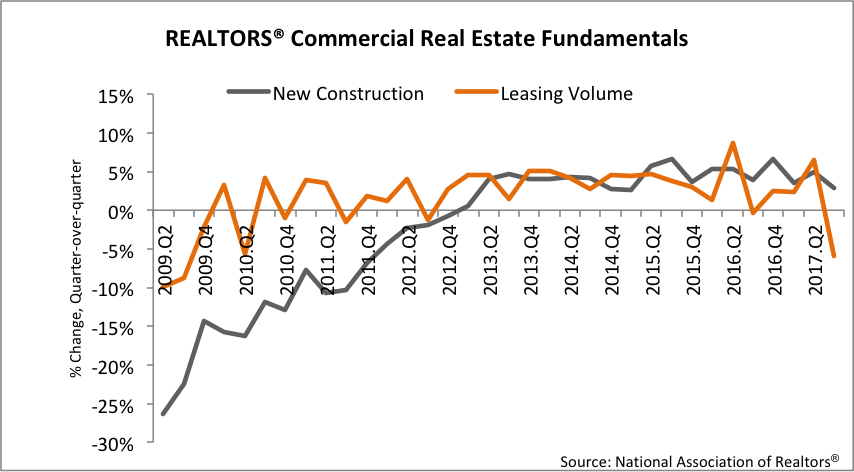

Commercial fundamentals in REALTOR® member markets stumbled in the third quarter of this year, despite an expanding economy. Leasing volume declined, posting a 5.9 percent slide from the preceding quarter. New construction increased by a slower 2.9 percent from the prior quarter, as developers faced higher construction costs and a shortage of labor. Leasing rates increased by a modest 1.1 percent, as concessions declined 1.6 percent.

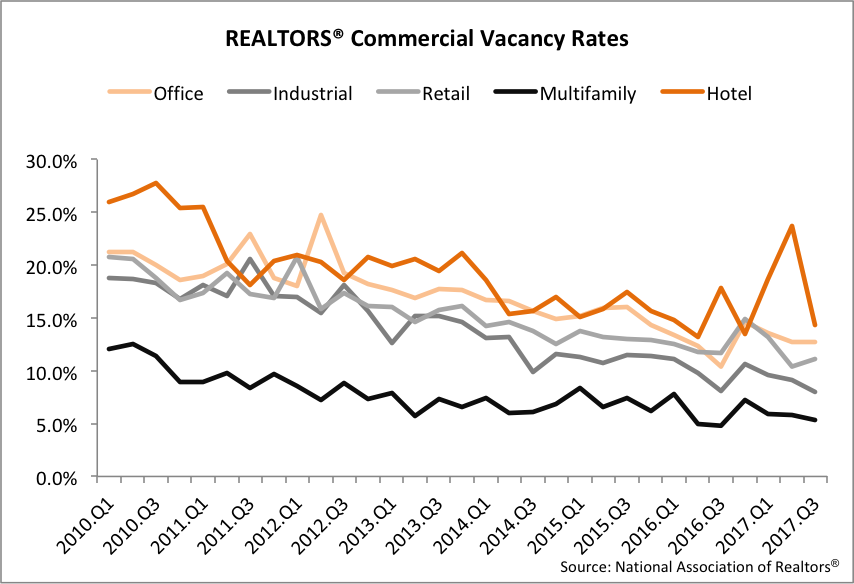

Vacancy rates continued declining in the third quarter of this year across the property types, with the exception of retail. Office vacancies reached 12.7 percent, while industrial dropped to 8.0 percent. Multifamily vacancies declined to 5.3 percent as household formation numbers advanced. Retail vacancies rose to 11.1 percent, as national department stores announced further store closings during the quarter.

To access the Commercial Real Estate Outlook: 2017.Q3 report visit https://www.nar.realtor/reports/commercial-real-estate-outlook.