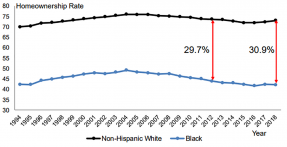

The U.S. Black homeownership rate today is lower than it was in 1968 when the Fair Housing Act, part of the landmark Civil Rights Act, was signed into law.

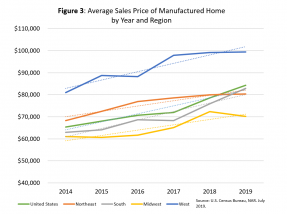

There are four home construction methods being used today: Site-built, Manufactured, Modular, and Panel.

Comparing June of 2009 to June 2019, the median price of a home increased in the US and all the four regions.

At the national level, housing affordability is up from last month and up from a year ago. Mortgage rates were down from last month at 3.84% this June, and down nearly one percentage point compared to 4.77% a year ago.

In July 2019, the NAR Health Insurance Survey was sent via email to a random sample of 57,990. It received 2,296 completed responses (with a total of 3,693 responses) and has a response rate of 3.95 percent. Here are the highlights of the survey, looking at health care coverage of NAR Members for 2019.

Prices continued to rise, with 91% of the markets showing home price appreciation. Single-family home price growth is steady, median family incomes are rising modestly, inventory levels are low and affordability has been declining.

Eighty-six percent of respondents reported that home prices remained constant or rose in June 2019 compared to levels one year ago (87 percent in June 2018).

Commercial real estate deals and prices of properties that are typically less than $2.5 million are still rising though at a modest pace, according to NAR’s 2019 Q2 Commercial Real Estate Market Trends & Outlook Report.

Foreign buyer purchases of U.S. existing homes during April 2018–March 2019 fell sharply to $77.9 billion from the $121 billion during the prior 12-month period (April 2017‒March 2018)—a 36% drop.

At the national level, housing affordability is down from last month, but up from a year ago. Mortgage rates were down from last month at 4.11% this May, and down 7.7% compared to 4.71% a year ago.

Search Economists' Outlook