With most states lifting the restrictions of business and public spaces, hundreds of millions of people started moving around again. Mobility typically brings economic development and, subsequently, a faster recovery in the local economy from the recent shutdown orders.

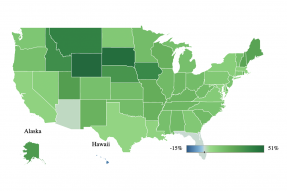

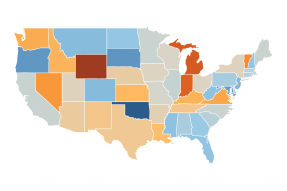

In considering where to move, potential home owners and renters have to keep their fingers on the pulse of home price and rent growth.

The Coronavirus Crisis has people struggling to pay bills: twelve percent of homeowners did not pay on time their mortgage last month, according to the U.S. Census.

With significant improvements in the job market, employment grew by 4.8 million new jobs in June.

The near 5 million job additions in a single month in June is off-the-chart the best ever by a wide margin.

The silent generation, aged 74 to 94 years, made up the smallest share of buyers by age at 6% of all homebuyers in 2019, and represented 8% of sellers.

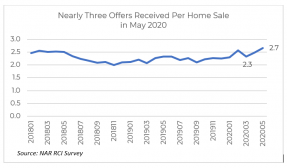

Housing market conditions improved in May, according to REALTORS® who responded to NAR’s May 2020 Realtors® Confidence Index (RCI) Survey, a survey of REALTORS® about their monthly transactions.

In the week ending June 13, seasonally adjusted new claims were 1,508,000, a decrease of 58,000 from the previous week's revised level. In the meantime, continued claims, which show how many Americans received unemployment benefits, also dropped to 20.5 million in the week ending June 6, a decrease of 62,000 from the previous week's revised level.

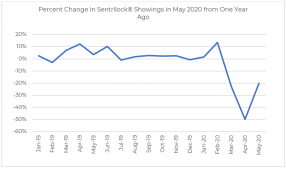

Home showings in May 2020 were still below last year’s level, but activity picked up compared to April.

At the national level, housing affordability remained promising in April 2020 compared to a year ago and rose compared to March.

Search Economists' Outlook