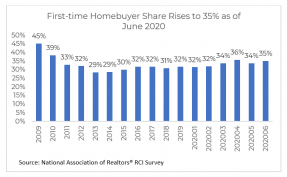

The share of first-time buyers increased in March through June—right into the heart of the pandemic period and the surge in unemployment—and is now trending higher than the 29% to 32% average in past years since 2012.

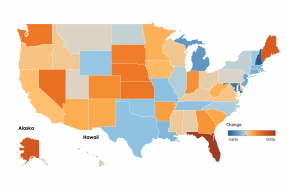

At the national level, housing affordability showed signs of improvement in May 2020 compared to a year ago but fell compared to April.

In the week ending July 11, new unemployment claims decreased to 1.3 million, a decrease of 10,000 from the previous week's revised level.

Suburban office space acquisitions have been on the rise since 2017, but this trend may pick up as a result of social distancing and increased opportunity to work from home.

The retail property market is one of the most negatively affected commercial markets by the coronavirus pandemic and measures taken to contain it.

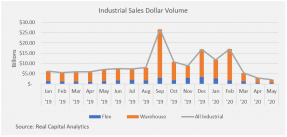

The industrial property market performed relatively well and was one of the investors' preferred asset classes as it was not as negatively affected by the coronavirus pandemic as others.

Compared to the retail or hotel/lodging commercial real estate market, the multi-family market is faring relatively well.

Home showings in June 2020 showed a strong rebound from the level in May.

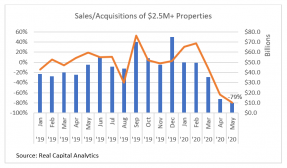

The commercial real estate sector continues to struggle as a result of the coronavirus pandemic.

In the week ending July 4, new unemployment claims decreased to 1.3 million, a decrease of 99,000 from the previous week's revised level.

Search Economists' Outlook