REALTORS® expect to have more sales transactions in residential and industrial land sales in the third quarter.

The U.S. Census Bureau released its second-quarter GDP estimates and reported that personal consumption spending fell by nearly 35% on a seasonally adjusted annual rate.

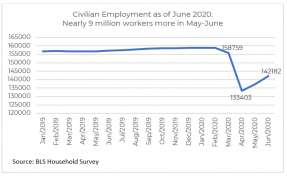

Layoffs are still happening with 1.4 million new filers for unemployment insurance, a slight increase of 12,000 from the prior week.

The housing market is hot because of lower mortgage rates, but the luxury market may remain soft due to jumbo loan issues.

As expected, economic activity collapsed in the second quarter due to the total virus-lockdown in April and only partial re-openings in May. The GDP contraction of 33% on an annualized basis is the steepest ever experienced in the U.S.

According to the Census Bureau's Residential Vacancies and Homeownership report for Q2 2020, the homeownership rate increased by nearly 4 percentage points, to 67.9%.

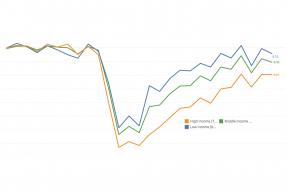

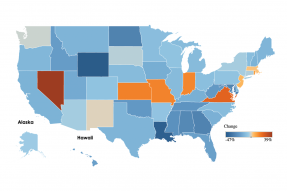

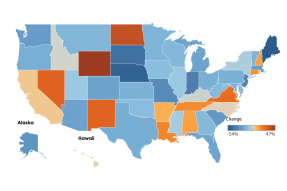

NAR has analyzed the ability of mortgage holders to meet their mortgage payments by state, age group, and income.

As jobs recover, the fraction of purchase contract terminations has started to decline again.

Layoffs are still happening, with 1.4 million new filers for unemployment insurance, an increase of 110,000 from the prior week. This seems to be because of the re-closing of business activity in some states (such as no indoor dining).

Interest rates inched up slightly, to 3.02% on a 30-year fixed-rate mortgage, but they are essentially at near-record-low levels. The housing market is hot because of the lower mortgage rates, but the luxury market may remain soft due to jumbo loan issues.

Search Economists' Outlook