The overall job market is still weak, with only 49,000 net new job creations in January following a 227,000 net loss in December.

Mortgage rates remained unchanged at 2.73% from the previous week. Given mortgage rates follow the trend of the 10-year Treasury yield, rates may rise modestly in the upcoming weeks.

The number of unadjusted new unemployment claims fell last week to 873,966, a decrease of 101,498 claims from the prior week.

This report presents key results about market transactions from the December 2020 REALTORS® Confidence Index survey.

The reasons store closures in 2020 weren't as high as forecasted can be found in retailers' extraordinary measures, consumer spending, and e-commerce.

Mortgage rates fell further this week, following the trend of the 10-year Treasury yield.

Worth noting is that residential investment posted the strongest growth among all components of GDP, contributing a third of the economic growth in the fourth quarter.

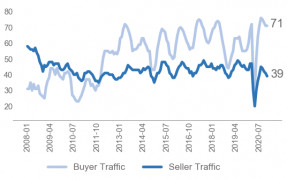

Here are five key trends from the REALTORS® Confidence Index survey of how the pandemic impacted the housing market in 2020.

Generally, taxpayers deduct property and income taxes using the SALT deduction.

Inventory levels and months' supply are measures of housing supply. Here is a quick look at both of these terms.

Search Economists' Outlook