The number of Americans applying for new jobless claims rose slightly by 13,000 last week to 861,000. Continued claims, which measure the number of people receiving checks for regular unemployment benefits, dropped below 5 million.

January 2021 seasonally adjusted advanced estimates of United States retail and food services sales saw a strong increase from December sales figures, with aid from the government stimulus package, vaccine rollout, and better COVID numbers as momentum from a historic holiday season carried over.

As expected, mortgage rates rose this week following the trend of the 10-year Treasury yield. Specifically, the 30-year fixed rate picked up to 2.81% from 2.73% the previous week.

Affordability increased in December compared to November as the median family income rose by 1.9% while the median home prices grew by 13.5%.

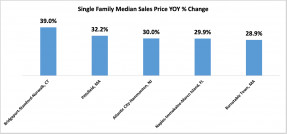

Prices continued to rise in Q4 2020, with 88% of the markets showing double-digit home price appreciation. National median prices rose 14.9% year-over-year to $315,900.

Unfortunately for malls, especially class C and D traditionally enclosed shopping centers for which account for majority of all U.S. malls, there are substantial retail space vacancies.

Both initial and continued claims for unemployment benefits dropped. However, 2.7 more people applied for special pandemic program benefits.

Mortgage rates remained unchanged at 2.73% for the second straight week as recent data shows that inflation remains subdued well below the Federal Reserve’s 2.0% core target.

The annual inflation rate continues to rise in January as the COVID-19 cases are falling and the vaccine is becoming available to more Americans.

The number of people seeking unemployment benefits fell further for third straight week to the lowest level in the last couple of months. It seems that the worst months for the labor market could be behind us.

Search Economists' Outlook