The average rate on the 30-year fixed rate home loan ticked up to 3.09% from 3.05% last week. However, a year after the pandemic struck our country, mortgage rates are still hovering into record lows around 3%.

U.S. retail and food services sales, a measure of consumer purchases at stores, restaurants and online, declined in February from the prior month. This is not concerning because it sank from an untypical January high.

At the national level, housing affordability increased in January 2021 both compared to a year ago and compared to December 2020.

Food service and drinking place sales increased 6.9% in January 2021 from December 2020 as some state and local authorities eased COVID-related restrictions.

U.S. long-term mortgage rates rose this week as the new stimulus package will become law sometime tomorrow. Freddie Mac reported today that the average rate on the 30-year fixed rate home loan ticked up to 3.05% from 3.02% last week.

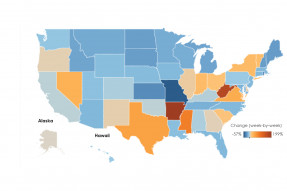

On the aggregate, the commercial real estate market has been hit hard by measures to control the COVID-19 pandemic. However, on closer look, some sectors and geographic markets have fared better than others.

As expected, the annual inflation rate continued to rise in February. Over the last 12 months, the inflation rate rose 1.7%, compared to 1.4% in the last two months.

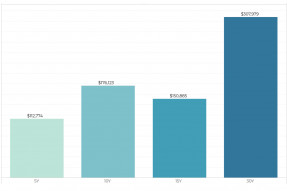

Homeowners who purchased a single-family existing-home 10 years ago at the median sales price of $170,567 with a 10% down payment loan and who sold the home at the median sales price of $315,700 in 2020 Q4 would have built up a home equity gain of $176,123.

Unadjusted initial claims rose by 31,519 to 748,078 last week, and continued claims, which measure the number of people receiving checks for regular unemployment benefits, dropped by 22,355 to nearly 4.8 million.

The job market strengthened in February with 379,000 net new job additions. More jobs are very likely, due to the near certain passage of the $1.9 trillion stimulus package and from two million vaccinations per day.

Search Economists' Outlook