The average rate on the 30-year fixed-rate home loan ticked up to 3.18% from 3.17% last week, following the upward trend of the 10-year Treasury yield.

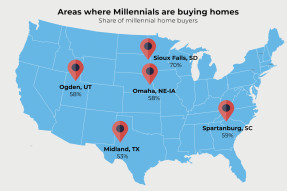

Millennial buyers (22 to 40 years old) continue to make up the largest share of home buyers at 37%. They've been the largest buyer group since 2014.

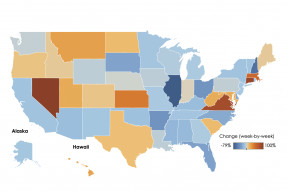

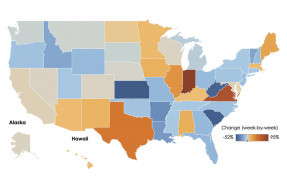

The February 2021 NAR SentriLock SentriKey® Home Showings Report shows an increase in nationwide foot traffic on a month-over-month basis.

In February 2021, properties were typically on the market for 20 days, and first-time buyers accounted for 31% of sales.

Home prices continued to power ahead, with the Case-Shiller price index rising 11.2%, the fastest appreciation since 2006.

Job market momentum seems to have picked up as the vaccine is becoming more widely available across the country, with thirty-two states reporting a decrease in new claims for the week ending March 20, 2021.

Although mortgage rates continued to rise this week, expect rates to remain low near 3.3% in 2021.

With demand for homes outpacing new listings, buyer competition continues to intensify.

The Census Bureau reported a 9.5% year-over-year increase in U.S. retail trade sales in February, a deceleration from the very strong holiday quarter and January’s 10.8% year-over-year increase.

A year after the pandemic hit our country, jobless claims remain elevated near 800,000. Although claims are significantly lower than the beginning of the pandemic, nearly 3 times as many people applied to receive unemployment benefits last week compared to pre-pandemic.

Search Economists' Outlook