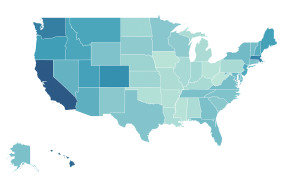

Housing affordability fell nationally in March 2024 compared to the previous month, with monthly mortgage payments increasing by 2.8% and the median price of single-family homes rising 2.4%.

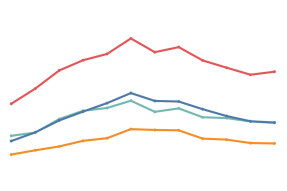

News of some cooling in the labor market could mean the topping-out of mortgage rates this week before more sustained declines through the remainder of this year.

At 7.22%, the 30-year mortgage interest rate has hit its highest point since November 2023; rates are unlikely to move down soon.

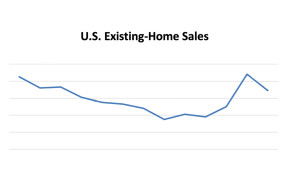

Despite facing market challenges like historically low inventory, heightened mortgage rates, and the lowest annual sales since 1995, REALTORS® remained committed to giving back to the communities they serve.

The housing sector is a significant contributor to gross domestic product (GDP) through construction, home sales, and renovations.

In March 2024, pending home sales rose 3.4% from last month and increased modestly (0.1%) from a year ago.

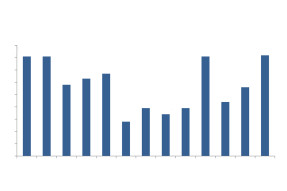

Seasonality refers to predictable changes in time series data that correlate with certain times of the year; understanding it will help us anticipate trends in the upcoming months.

Mortgage interest rates for the week sit at an average of 7.17%, and may show little dramatic downward movement any time soon.

Housing market activity declined 4.3% in March 2024, reaching a 4.19 million seasonally adjusted annual rate, down 3.7% from March 2023.

Housing affordability declined nationally in February compared to the previous month, the monthly mortgage payment decreased by 3.0%, and the median price of single-family homes declined modestly by 1.5%.

Search Economists' Outlook