In 2021, single-family existing-home prices rose at the fastest pace in five decades at an average year-over-year pace of 18%, driven by strong job growth, historically low mortgage rates, a post-pandemic recovery in household formation, and inadequate housing construction and pandemic-induced supply bottlenecks.

At the national level, housing affordability fell in October compared to the previous month, with monthly mortgage payment up by 3.1% and median family income up by 0.7%.

Amid the economic uncertainty wrought by the emergence of the omicron COVID variant, fewer leases were signed and office occupancy fell again in 2021 Q4.

Consumer prices rose 6.8% in November, with higher food and gasoline prices; rents are accelerating and utilities are higher by 25%.

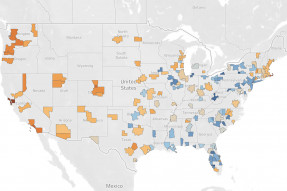

The year 2021 has been a record-breaking year for both home sales and home rentals, but with home prices and rents rising at a double-digit pace, is there anywhere still relatively cheaper to own than to rent?

Mortgage rates continued to remain roughly stable for the last 4 weeks, despite volatility in bond yields. The 30-year fixed mortgage rate slightly fell to 3.10% from 3.11% the previous week.

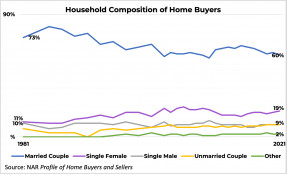

Why are women more likely to buy homes, and how do their financials compare to single men buying homes? NAR Research takes a look at the answers.

NAR used estimates from the American Community Survey to provide a snapshot of housing in America in 2020.

The unemployment rate continued to plunge and is now at 4.2%, which is actually below March 2020 levels when the ugly COVID virus came to the country. This measurement should be taken with a grain of salt, however, since only those searching for a job are counted.

The industrial sector is on pace for a historical year despite the supply chain issues that had an impact on the shipping of goods.

Search Economists' Outlook