Mortgage rates are plunging with the news of inflation calming. The interest rate rises should be over, and the Fed will have to consider cutting interest rates seriously.

Let's take a look at some of the most interesting findings from the 2023 Profile of Home Buyers and Sellers.

National median home prices rose by 1.1% compared to the previous quarter and 2.2% year over year to $406,900.

Housing consumers have a bit of relief this week as the 30-year fixed mortgage interest rate dipped lower to 7.5%, falling one-quarter of a percent and hitting the lowest point in a month.

The latest monthly job gains of 150,000 in October are one of the weakest in the past three years. The unemployment rate rose to 3.9%, close to a two-year high.

The 30-year fixed mortgage interest rate remained nearly unchanged this week, possibly being the turning point for the relief potential home buyers and sellers need.

In September 2023, the pending home sales pace increased 1.1% from the previous month but fell 11% year-over-year.

Based on NAR Research's forecast released today, the 30-year fixed rate is expected to peak in Q4 2023 and then decline—hitting 6.9% in Q2 2024.

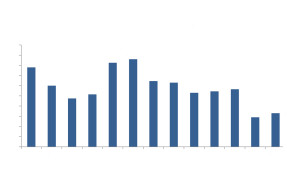

Between 2018 and 2022, most applicants received a mortgage rate below 3%. In 2022, most applicants secured a rate between 5.5% and 6%.

Compared to one year ago, affordability fell in August as the monthly mortgage payment climbed 26.2% and median family income rose 4.7%.

Search Economists' Outlook